Tax Planning for Executives: How an Executive Reduced Taxes by $100K

- Mark Chisenhall, CFA

- Apr 1, 2024

- 3 min read

Updated: Oct 21, 2025

In this quick case study, let's review how Melinda, a high earning executive, reduces her annual tax bill by $100K using tax efficient tactics available to most executives.

How Melinda Reduced Taxes by $100K

Melinda is Vice President of International Finance, earns $650,000/year and is married to a professor at the University of Arkansas. The couple is in the 37% marginal tax bracket at the Federal level and is also subject to Arkansas State Tax, Net Investment Income Tax and the Additional Medicare Tax - all of which can be comparatively reduced in retirement.

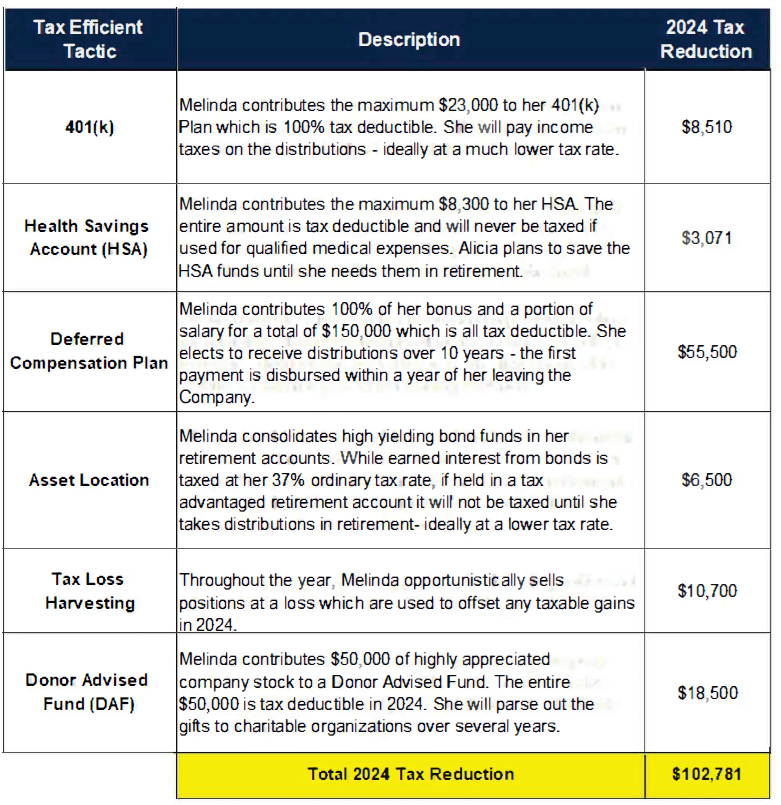

Melinda's goal is to defer as much taxable income as possible to the future when she plans to be in a lower tax bracket. The below chart illustrates how Melinda can reduce her current year tax bill by $100,000.

Assumptions: 37% Ordinary Tax Rate I 23.8% Long-Term Capital Gain Tax Rate I Bond Yield 5% I $1.5M Investable Assets with 50% in Brokerage/50% in Tax Deferred account I Asset Mix is 50% Equity / 50% Bonds I Portfolio Turnover is 20% I Average Cost Basis is 70% I State Tax, NIIT and Payroll Taxes not accounted for.

It is important to note that these taxes are mostly deferred. She will pay taxes on this income eventually - excluding the HSA and DAF contributions. For high earning professionals that are likely paying the highest tax rates of their lifetime, deferring taxes can generate significant wealth in two ways:

Tax Arbitrage: Deferring income taxes while you are in a high tax bracket in exchange for paying taxes at a lower tax rate in the future.

Interest Free Loan: While you have a tax liability embedded in your tax deferred accounts, you are able to invest and earn a return on those funds, possibly for decades.

In most cases, successful and impactful tax planning is the result of several tactics that each incrementally improve the tax efficiency of your financial and human capital. This is especially true when the incremental improvements are consistent and repeatable over several years. While investment returns are not necessarily consistent over the short-term, the benefits from tax planning are much more predictable.

Thanks for reading,

Mark Chisenhall, CFA, MBA

Financial Advisor | Founder of Taurus Financial Planning Schedule an Introduction

Taurus Financial Planning is a Fee-Only Wealth Management firm based in Bentonville, AR. The firm offers comprehensive financial planning, tax planning and investment management to corporate executives across the country.

Taurus Financial Planning is a Registered Investment Advisor with the State of Arkansas. This information is provided as a guide to assist you in your financial planning. The specific examples are provided for illustration purposes only and are not representative of specific investments or guarantees of future returns. Please consult with a professional for specific questions regarding your particular situation. If there is any error or inconsistency between this document and the official company plan documents, your company plan documents will govern.

This publication is for informational purposes only and is not intended as tax, accounting or legal advice or as an offer or solicitation of an offer to buy or sell or as an endorsement of any company security fund or other securities or non securities offering. This publication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made by the Author, in the future, will be profitable or equal the performance noted in this publication.